Offshore Company Formation for Investors and Wealth Managers

Offshore Company Formation for Investors and Wealth Managers

Blog Article

The Ultimate Resource for Anybody Curious About Offshore Company Formation Approaches

Offshore Company Formation provides a strategic possibility for entrepreneurs looking for to expand their service perspectives. Understanding the nuances of establishing a lawful entity abroad is vital. From picking the right jurisdiction to maneuvering complicated tax landscapes, there are a number of factors to consider. This resource aims to brighten the procedure while highlighting vital advantages and conformity needs. As the journey unfolds, the ramifications of these options become significantly substantial, motivating additional expedition right into efficient approaches.

Understanding Offshore Company Formation

Why do entrepreneurs consider overseas Company Formation as a feasible technique? This question reflects the expanding rate of interest in establishing firms in international territories. Offshore Company Formation includes establishing a lawful company entity outside the business owner's home nation. Business owners are attracted to this method for numerous reasons, consisting of governing benefits and enhanced personal privacy. They look for beneficial tax obligation regimens, structured conformity processes, and the potential for asset protection.Understanding offshore Company Formation calls for experience with the lawful structures and needs of different jurisdictions. Each nation provides unique motivations and difficulties, making it essential for business owners to carry out complete research study. Secret aspects consist of the simplicity of incorporation, continuous compliance commitments, and the political stability of the selected location. Entrepreneurs need to additionally consider global laws and treaties that might influence their company operations. On the whole, understanding of offshore Company Formation prepares for informed decision-making in a globalized economic climate.

Secret Benefits of Offshore Companies

Offshore firms use several advantages that attract company owner and financiers alike. Trick benefits include tax obligation optimization approaches that can significantly minimize responsibilities, asset protection steps that protect wealth from possible claims, and enhanced privacy methods that ensure discretion. Comprehending these advantages is crucial for any person considering the Formation of an offshore entity.

Tax Obligation Optimization Strategies

Property Security Conveniences

Establishing an offshore Company not only gives tax optimization yet additionally provides substantial asset security advantages. Offshore entities can serve as a barrier against legal claims, lenders, and political instability in the proprietor's home country. By holding possessions in a foreign jurisdiction, people can protect their wide range from claims and prospective confiscation. Additionally, several offshore jurisdictions have regulations that favor the protection of business assets, making it difficult for creditors to access them. This critical positioning of possessions can enhance monetary safety and security and offer assurance. Moreover, the legal frameworks linked with offshore firms often permit better control over possession management, making sure that proprietors can secure their investments efficiently. In general, possession security continues to be an engaging factor to examine overseas Company Formation.

Improved Privacy Procedures

Just how can individuals effectively safeguard their economic personal privacy in an increasingly transparent world? Offshore companies offer a feasible remedy by offering enhanced privacy procedures that secure the identities of their proprietors. Several territories enable for candidate services, where 3rd parties are appointed to act on behalf of the actual owners, thus securing their names from public records. Furthermore, offshore entities typically take advantage of stringent data protection regulations, ensuring that delicate details stays personal. The usage of offshore checking account related to these companies even more safeguards financial purchases from spying eyes. As a result, individuals seeking to preserve discretion in their monetary affairs find offshore Company Formation an efficient technique for enhanced personal privacy and safety.

Picking the Right Territory

Selecting the ideal territory is essential for any person taking into consideration offshore Company Formation, as it can substantially impact tax obligations, regulatory needs, and general business procedures. Different elements must be reviewed when making this decision. Tax motivations, such as low business tax prices or tax obligation holidays, can significantly enhance productivity. In addition, the political security and financial environment of a jurisdiction are important, as they influence company security and development potential.Moreover, the simplicity of operating, including the effectiveness of Company registration procedures and the availability of specialist solutions, need to be considered. Some jurisdictions are known for their durable financial facilities, while others may offer discretion advantages that are attractive to service owners. Ultimately, a comprehensive analysis of these aspects will certainly direct individuals in choosing a jurisdiction that lines up with their operational objectives and risk tolerance, guaranteeing a tactical structure for their offshore ventures

Legal and Regulatory Compliance

Recognizing the lawful and governing framework of the selected jurisdiction is vital for effective offshore Company Formation. Compliance with local regulations warranties that the Company operates legitimately and prevents possible legal issues. Each territory has its own collection of regulations, varying from registration needs to continuous coverage obligations.Certain territories may mandate specific licensing, while others concentrate on anti-money laundering (AML) regulations and due diligence actions. Business should likewise recognize their responsibilities pertaining to shareholder and director details, which may need to be revealed to authorities.Failure to stick to these legal specifications can cause fines, fines, or also the dissolution of the Company. For that reason, seeking advice from legal and compliance professionals is important to browse these intricacies effectively. By developing a solid structure in conformity, services can appreciate the benefits of overseas consolidation while decreasing risks connected with non-compliance.

Tax Factors To Consider and Implications

Tax obligation considerations play a crucial role in the decision-making process for overseas Company Formation. By comprehending the potential offshore tax benefits, companies can tactically position themselves to optimize their monetary outcomes. However, compliance with worldwide guidelines remains critical to avoid lawful complications.

Offshore Tax Perks

Countless people and organizations discover overseas Company Formation mostly for the significant tax click here obligation benefits it can supply. Offshore jurisdictions usually offer reduced tax obligation rates or perhaps zero taxes on specific kinds of earnings, making them appealing for wealth conservation and growth. This can include minimized corporate tax obligation prices, exemptions on resources gains, and the absence of estate tax. In addition, overseas companies can help organizations and people enhance their tax responsibilities via critical planning and the usage of double tax treaties. These advantages can enhance money circulation and earnings, enabling for reinvestment or repatriation of funds without extreme tax worries. Comprehending these benefits is important for anybody taking into consideration offshore Company Formation as part of their economic technique.

Conformity and Rules

While overseas Company Formation provides attractive tax obligation advantages, it is just as crucial to browse the compliance and regulatory landscape that comes with such setups (offshore company formation). Numerous jurisdictions enforce stringent laws concerning coverage and financial disclosures, calling for business to maintain transparency. Failing to abide can lead to extreme penalties, consisting of substantial penalties and even dissolution of the Company. In addition, tax treaties and global arrangements demand mindful consideration of tax responsibilities in both the offshore territory and the individual's home nation. Organizations have to likewise stay updated on advancing guidelines, as governments progressively scrutinize offshore activities. For that reason, professional guidance is critical to ensure adherence to all legal requirements and to enhance the benefits of overseas Company Formation

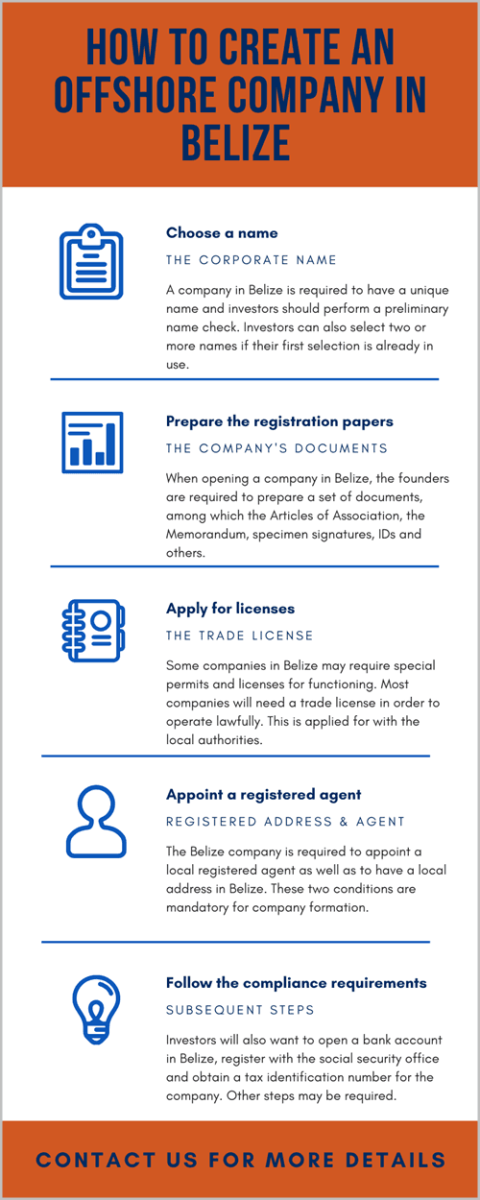

Steps to Set Up Your Offshore Company

Establishing an overseas Company entails a series of systematic steps that can improve the procedure and maximize benefits. People need to select the appropriate jurisdiction that straightens with their service goals, thinking about factors such as tax benefits, privacy, and regulative atmosphere. Next off, they must select an appropriate organization framework, such as a minimal obligation Company or company, which will affect responsibility and taxation.Once the structure is figured out, the needed documentation should be prepared, including posts of unification and identification for shareholders and directors. Following this, the specific have to open a bank account in the chosen territory to facilitate financial operations.Finally, it's vital to adhere to regional regulations by acquiring necessary licenses or authorizations and making sure continuous conformity with reporting commitments. By adhering to these steps, business owners can efficiently establish up their offshore business and placement it for success.

Maintaining Your Offshore Entity

Maintaining an overseas entity requires cautious attention to various compliance and functional facets. Normal filing of essential files, such as economic statements and annual returns, is imperative to stick to the jurisdiction's guidelines. Failing to comply can lead to fines or loss of the entity's status.Additionally, maintaining accurate and updated documents is necessary for transparency and audit purposes. Offshore entities commonly need a local registered agent to meet legal obligations and help with communication with authorities.Tax compliance is one more considerable facet; recognizing the tax effects in both the offshore jurisdiction and the home nation assurances that the entity runs within legal frameworks.Lastly, periodic evaluation of the entity's framework and operations can enhance its advantages. By staying educated and proactive, proprietors can successfully handle their overseas entities and optimize their calculated benefits.

Often Asked Inquiries

Can I Open Up a Savings Account for My Offshore Company Remotely?

Many people make inquiries whether it is feasible to open up a checking account for an offshore Company remotely. Typically, this is possible, yet demands differ by jurisdiction and particular bank policies should be followed accordingly.

What Are the Common Misconceptions Concerning Offshore Business?

Just How Do Offshore Business Shield Against Political Instability?

Offshore companies can mitigate dangers connected with political instability by expanding assets in steady jurisdictions, offering legal defenses, and allowing versatile monetary administration. This method helps guard investments versus damaging political growths in their home nations.

Exist Any Kind Of Limitations on Ownership for Offshore Business?

Limitations on ownership for offshore companies vary by jurisdiction. Some countries impose limits on international ownership or call for neighborhood supervisors, while others provide full versatility. Potential owners ought to extensively research details guidelines in their selected place.

Just How Can I Ensure My Offshore Company Remains Anonymous?

To assure privacy for an overseas Company, individuals can utilize candidate solutions, establish trusts, and choose territories with stringent privacy legislations. Consulting legal experts is necessary to maintain and navigate policies discretion effectively. They look for favorable tax routines, streamlined compliance processes, and the potential for asset protection.Understanding overseas Company Formation calls for experience with the legal structures and requirements of different jurisdictions. In addition, overseas firms can facilitate effective profit repatriation via different structures, such as holding firms or global trading entities. Picking the ideal jurisdiction is crucial for anybody thinking about overseas Company Formation, as it can substantially influence tax responsibilities, regulative demands, and total business operations. Many people and services explore offshore Company Formation primarily for the substantial tax obligation advantages it can offer. Offshore entities commonly need a local authorized agent to accomplish lawful commitments and promote interaction with authorities.Tax compliance is an additional considerable facet; recognizing the tax ramifications in both the overseas jurisdiction and the home nation assurances that the entity operates within lawful frameworks.Lastly, routine review of the entity's framework and procedures can maximize its advantages.

Report this page